In this guide, we’ll navigate the landscape of emergency loans in New Zealand, helping you understand what they entail

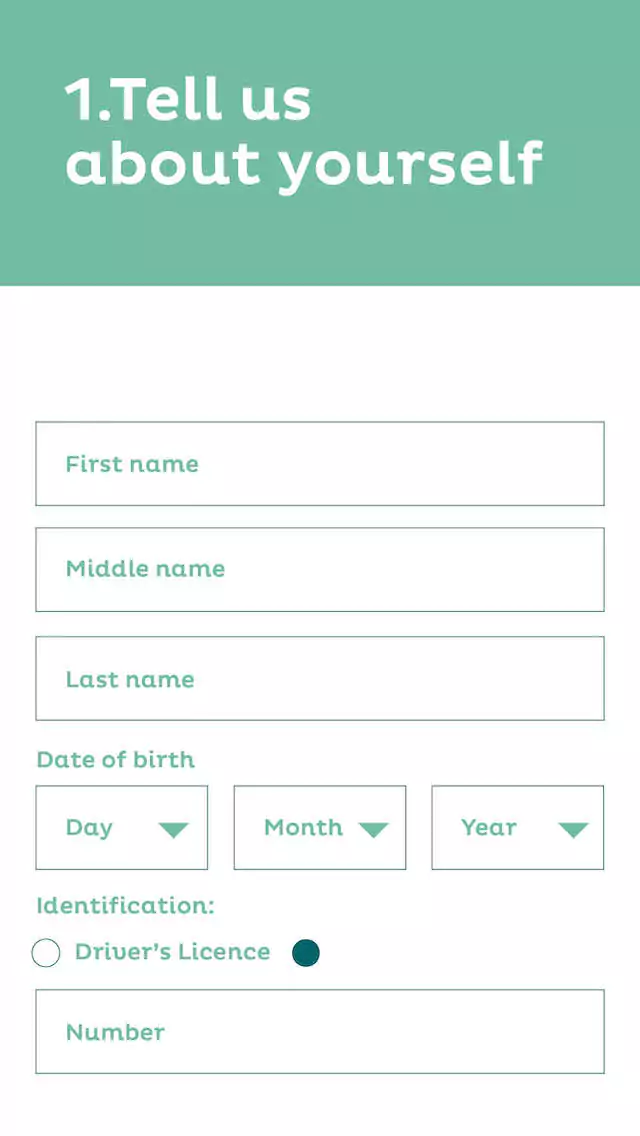

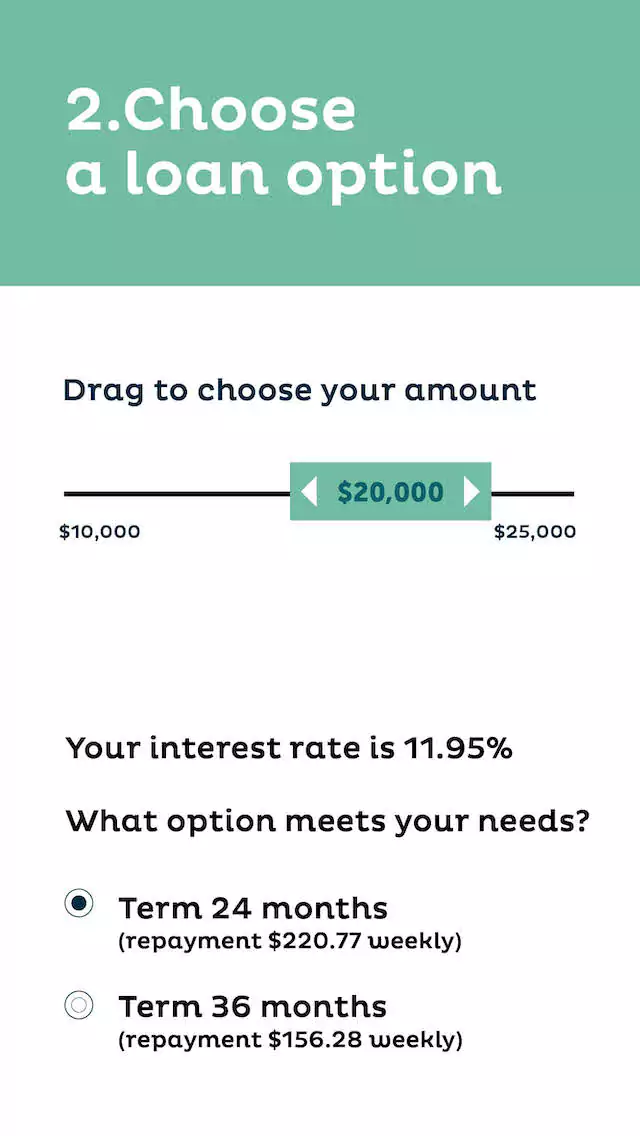

Read MoreAn emergency personal loan is a fast, unsecured loan designed to cover urgent expenses. You apply online and, if approved, funds can be paid quickly to help with things like car repairs, medical or dental bills, vet bills, essential home repairs or catching up on priority bills. Nectar offers emergency loans in NZ with fixed repayments and no early repayment fees.