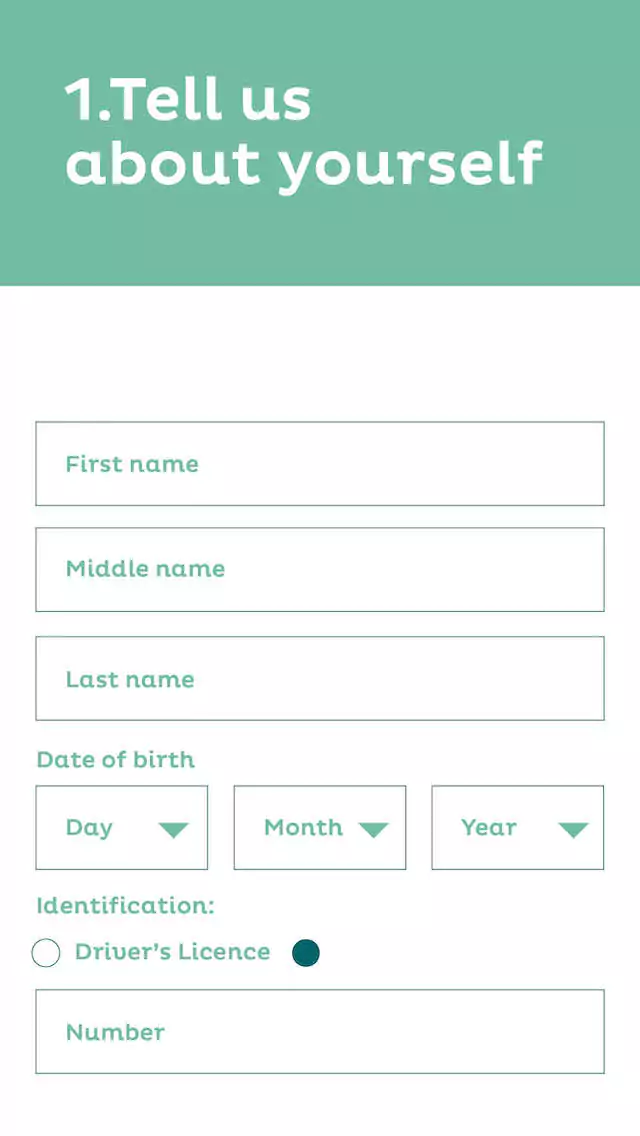

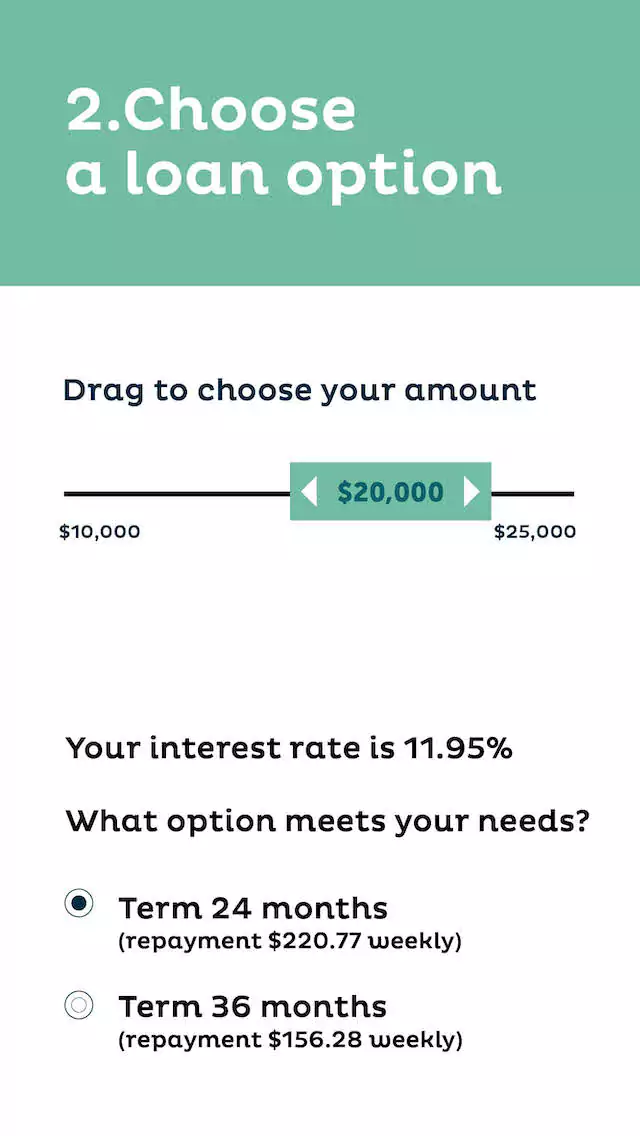

Purchasing a car can be a significant financial burden. Affordable car loans can help get you on the road quickly.

Read MoreIf you don’t supply vehicle details within 60 days, your loan switches to our unsecured rate — your current interest rate plus 3% p.a. — and we’ll issue a variation notice.