Recently engaged? Spending your weekends visiting wedding venues? Sick of agonising over the wedding guest list with your in-laws?

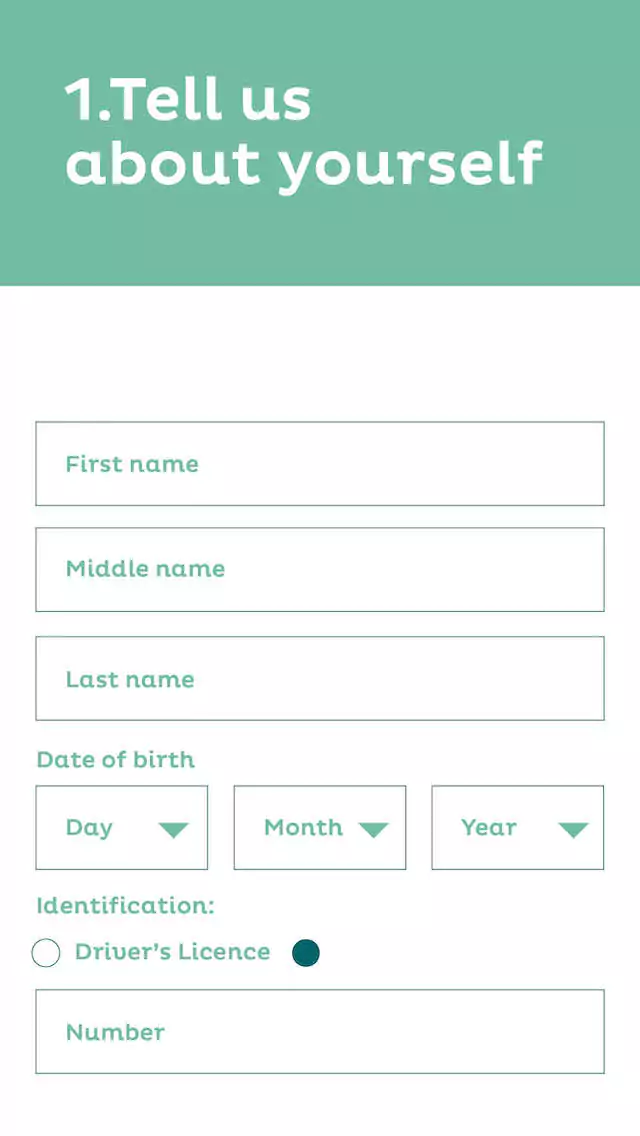

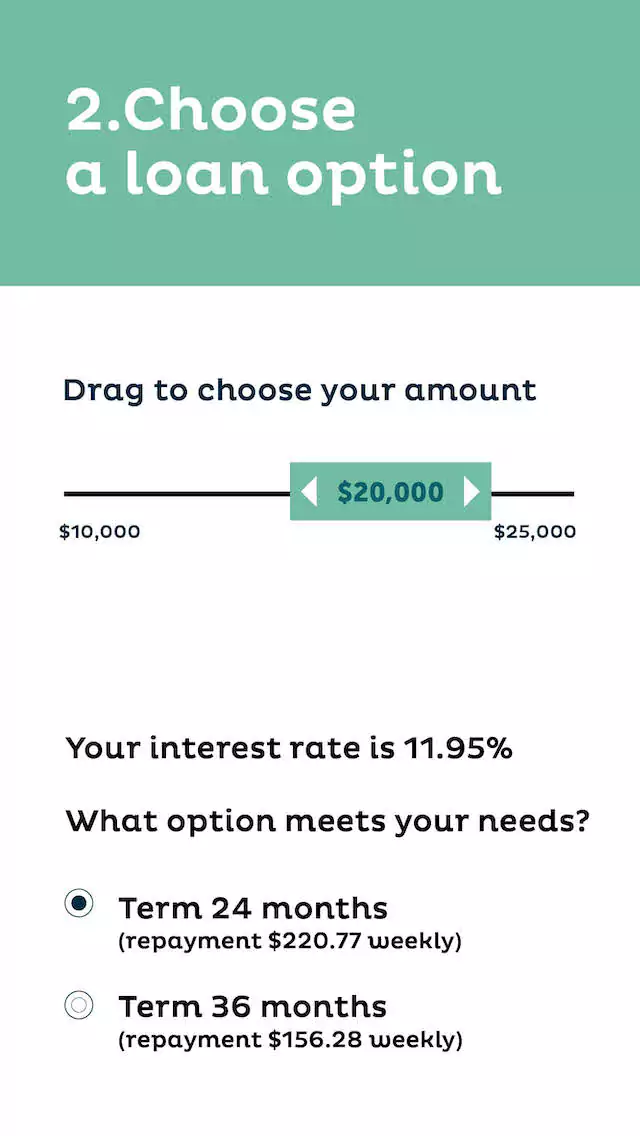

Read MoreA wedding loan is a fixed-term personal loan used to cover wedding-related costs like venue deposits, catering, photography, attire, and décor. You repay it in regular instalments with a fixed interest rate, so your repayments stay the same.

See more: Guide to Smart Wedding Loans in NZ