What home improvements will pay off in your final sale price? We look at key considerations when renovating for resale.

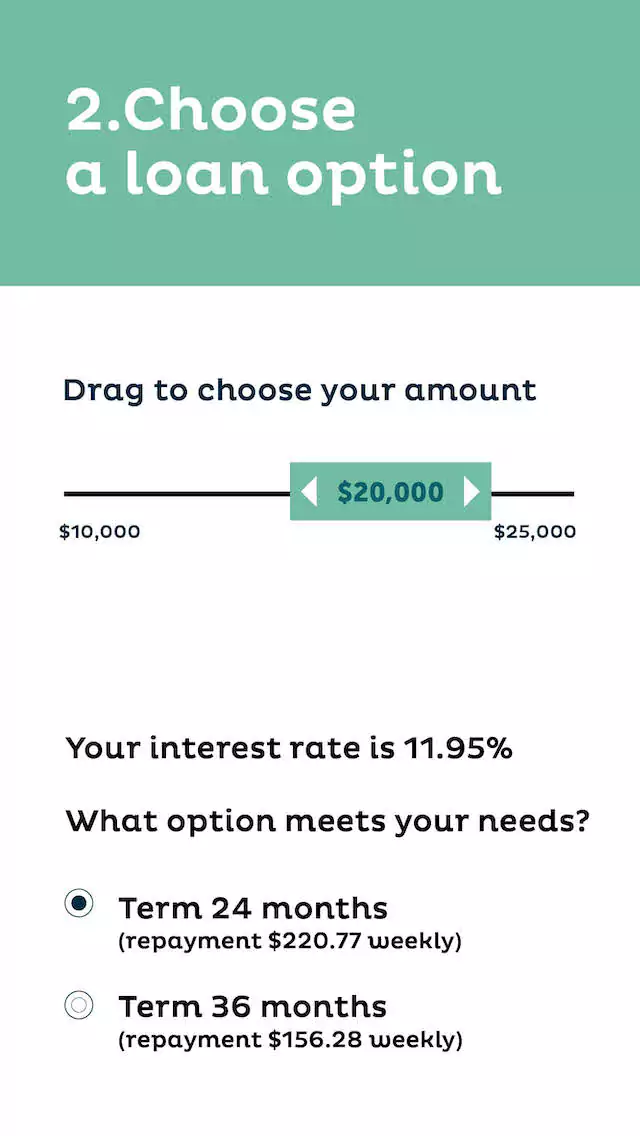

Read MoreA home improvement loan is an unsecured personal loan you can use for renovations and upgrades — from kitchens and bathrooms to insulation, roofing, flooring or landscaping. Apply 100% online, get an instant personalised quote in about 7 minutes, and if approved and signed during processing hours we aim to pay funds the same day.