The primary advantages of open-banking data verification for financial solutions encompass enhanced efficiency, heightened security, and elevated customer satisfaction. This article illustrates how real-time data access not only streamlines loan processing but also reduces operational costs and fosters trust among consumers. These elements culminate in a more responsive and inclusive lending environment, ultimately benefiting all stakeholders involved.

Open-banking data verification is revolutionising the financial services landscape, delivering unparalleled advantages for both lenders and consumers. By leveraging real-time financial information, platforms like Nectar Money are streamlining loan processes and bolstering transparency and security for borrowers.

As the demand for faster, more tailored financial solutions escalates, the question arises: how can businesses effectively harness open banking to address these shifting consumer expectations while upholding responsible lending practises?

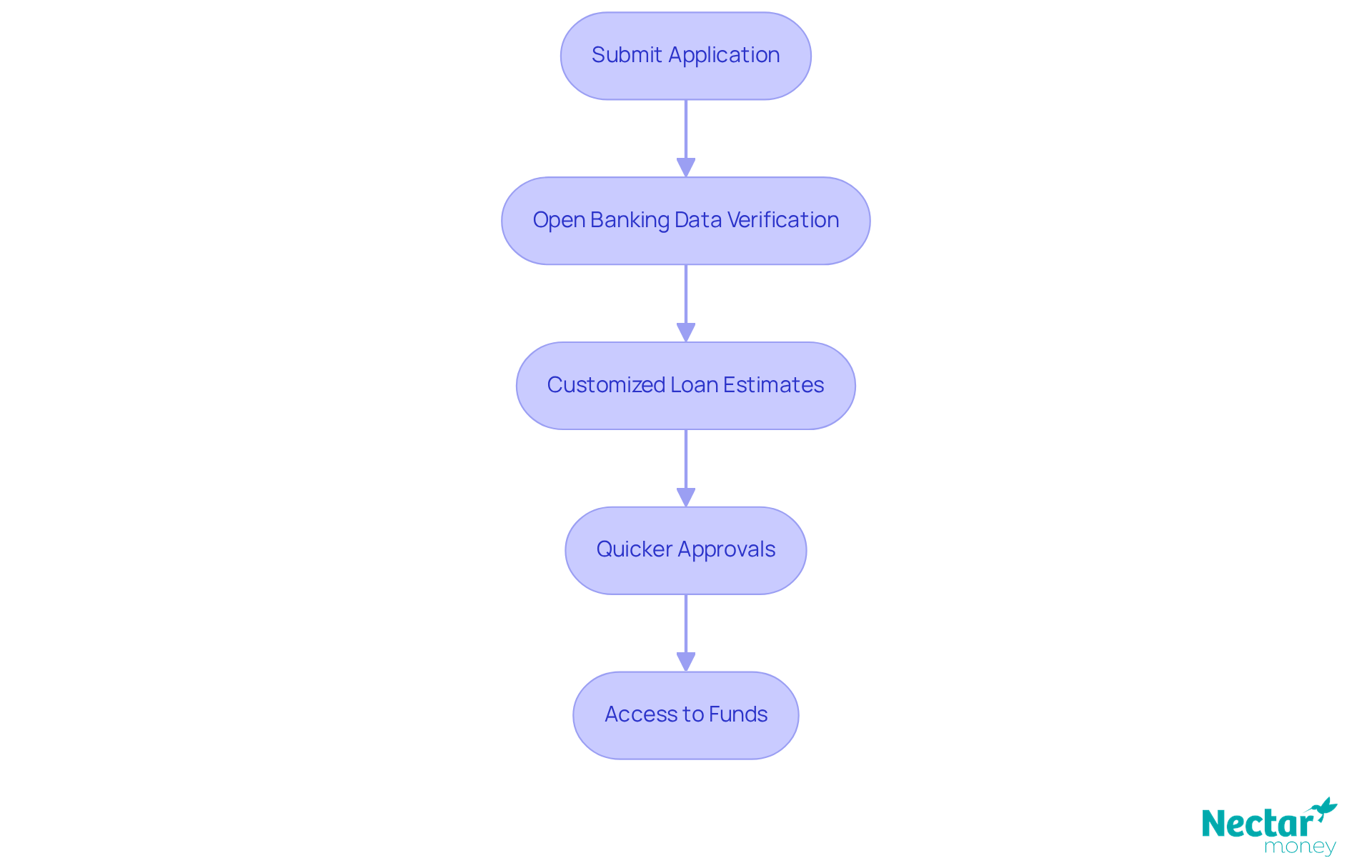

Nectar Money has harnessed the power of open-banking data verification to revolutionise the personal loan application process. Utilising real-time monetary data, the platform delivers customised loan estimates in mere minutes, ensuring clients receive tailored solutions that address their unique economic situations. This innovative approach not only enhances user experience but also reinforces the company’s commitment to responsible lending practises, facilitating quicker and more efficient access to funds for borrowers.

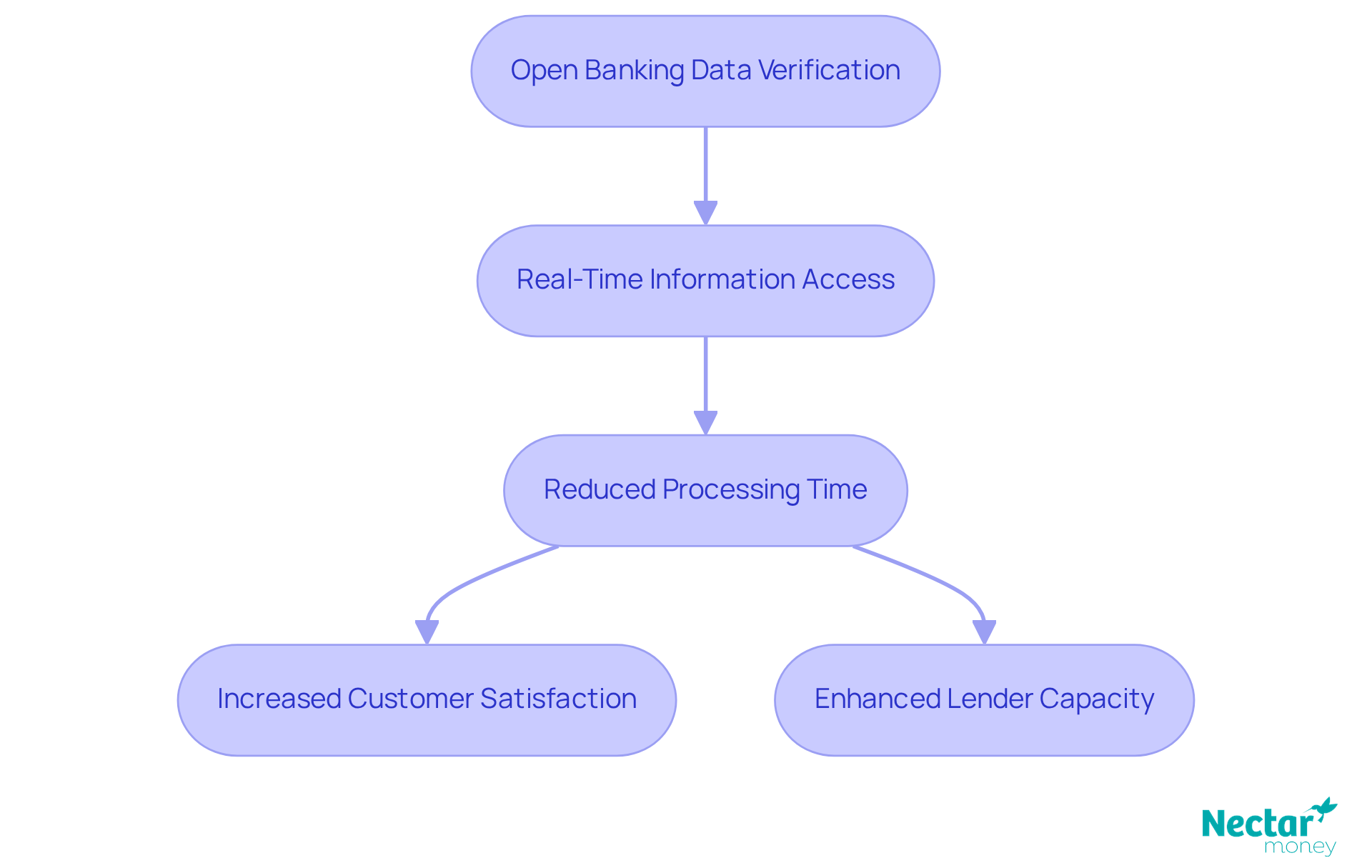

The impact of open-banking data verification on personal loan processing times is significant. Financial experts note that this technology streamlines the process of open-banking data verification, markedly reducing the time required to assess loan applications. Consequently, borrowers can anticipate quicker approvals and funding, which is essential for those facing urgent monetary needs.

By 2025, the benefits of open-banking data verification in lending will be increasingly evident. Streamlining the loan application procedure positions the company to meet the demands of a rapidly changing economic landscape. A case study on the New Zealand Inland Revenue’s exploration of open banking technology illustrates how similar initiatives can enhance efficiency and user satisfaction in monetary services.

Overall, Nectar Money’s dedication to integrating open-banking data verification not only enhances processing efficiency but also aligns with broader trends in the sector, paving the way for a more responsive and customer-focused lending environment.

Open-banking data verification significantly enhances transparency by providing consumers with real-time access to their financial information. This capability allows borrowers to gain a clearer understanding of their economic standing, which is essential for making informed decisions regarding loan options. With insights into their financial well-being, customers can select loans that align with their repayment abilities, thereby fostering a culture of responsible borrowing.

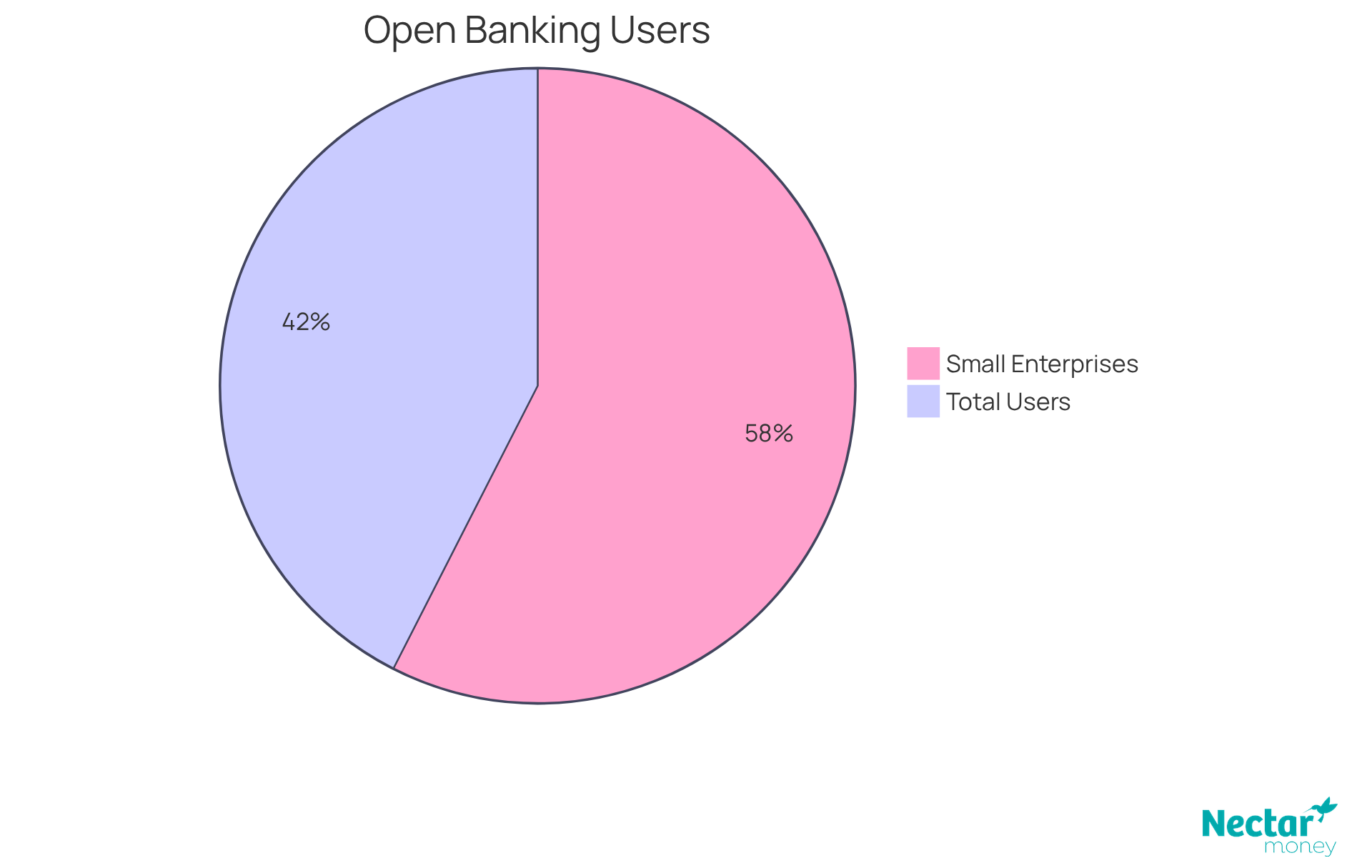

The growing adoption of open banking is evident, with 13.3 million users in the UK actively engaging with these services. This technology not only empowers individuals but also improves their overall money management. The impact is particularly notable among small enterprises, which exhibit an 18% penetration rate, utilising open banking for enhanced resource management and productivity.

By facilitating access to real-time information through open-banking data verification, financial services enable clients to navigate their financial decisions with confidence. This ultimately promotes a more educated and responsible borrowing environment, encouraging borrowers to make choices that are in their best interest.

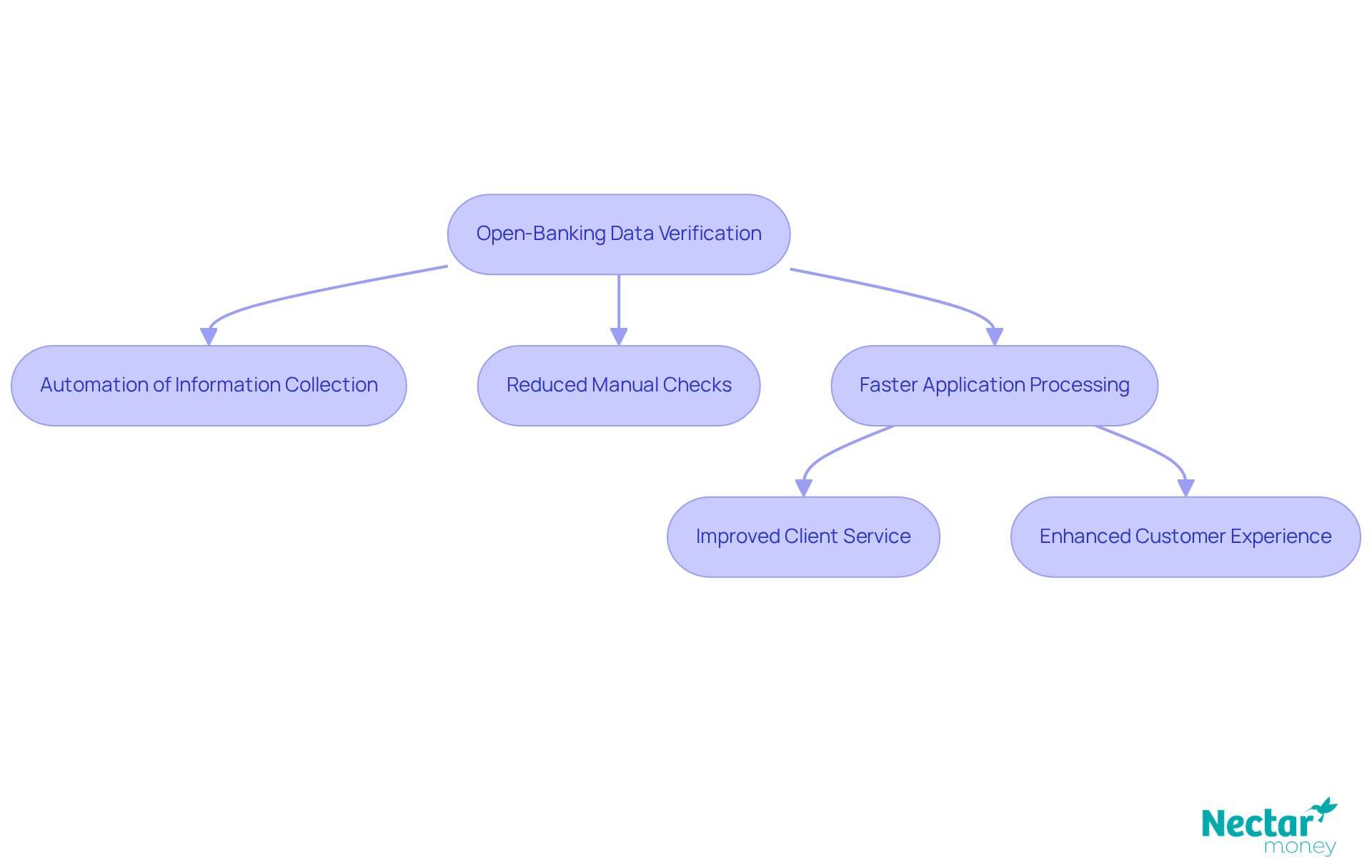

Open-banking data verification significantly enhances operational efficiency for lenders in the industry by automating information collection and verification processes. This automation reduces the reliance on manual checks, which traditionally consume substantial time and resources. As a result, Nectar’s platform accelerates application processing, enabling faster decisions and improved resource distribution. Industry leaders highlight that integrating open-banking data verification can reduce loan processing times by up to 40%, enabling lenders to serve clients more effectively.

For example, brokers employing open banking technology can access client data within 7-12 minutes after obtaining consent, streamlining workflows and improving customer service. By leveraging these efficiencies, the company not only boosts its operational capabilities but also elevates the overall customer experience, making it a preferred choice for borrowers seeking prompt financial solutions. Clients have praised the service for its rapid approvals and exceptional support, reinforcing the firm’s commitment to providing flexible loan solutions tailored to individual needs.

This focus on customer experience, coupled with a dedication to financial literacy, positions the company as a leader in transforming personal loans in New Zealand.

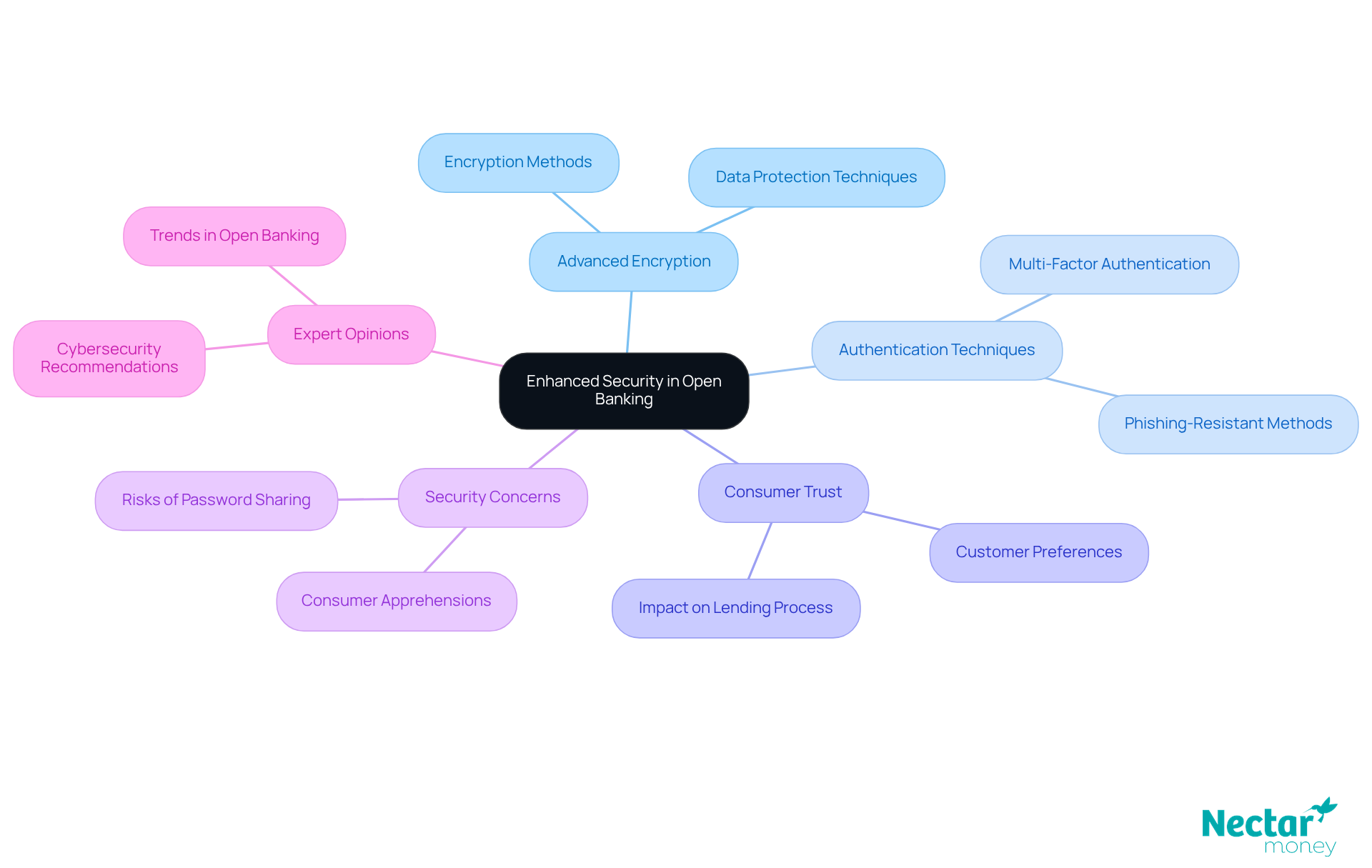

Open-banking data verification significantly enhances security through advanced encryption and authentication techniques designed to protect consumer information. By enabling customers to securely share their financial data with lenders, Nectar Money effectively mitigates the risk of security breaches and fraud. This elevated level of security not only safeguards consumers but also cultivates trust in the lending process, motivating more individuals to seek financial solutions via digital platforms.

As a noteworthy trend, an increasing number of consumers express concerns about information security in online lending, with many highlighting the importance of safe information-sharing methods. A case study involving Finsure illustrates this shift; brokers have observed heightened customer apprehension regarding password sharing for screen scraping technology, which has led to a growing preference for open banking as a more secure alternative.

Cybersecurity experts emphasise that robust information protection measures are essential within the lending industry. This reinforces the notion that open-banking data verification is a crucial component for enhancing consumer information security and promoting responsible lending practises.

Open-banking data verification significantly accelerates transaction times, enabling finance companies to streamline loan approvals and disbursements. By leveraging real-time information, the platform reduces processing durations from weeks to mere hours—crucial for customers in need of prompt financial assistance. This heightened efficiency not only boosts customer satisfaction but also positions the service as a trustworthy option for those facing urgent cash requirements.

With competitive interest rates ranging from 9.95% to 29.95% and flexible loan terms from 6 months to 5 years, the company delivers tailored solutions that meet diverse economic needs. It is important for borrowers to consider the establishment fee of $240 and a $1.75 admin fee per repayment. The automation of information collection and verification through open-banking data verification empowers lenders to effectively manage a greater volume of applications, ultimately enhancing their capacity and profitability.

As a result, this service distinguishes itself in the competitive lending landscape, addressing the growing consumer demand for swift financial solutions while fostering economic literacy and responsible borrowing.

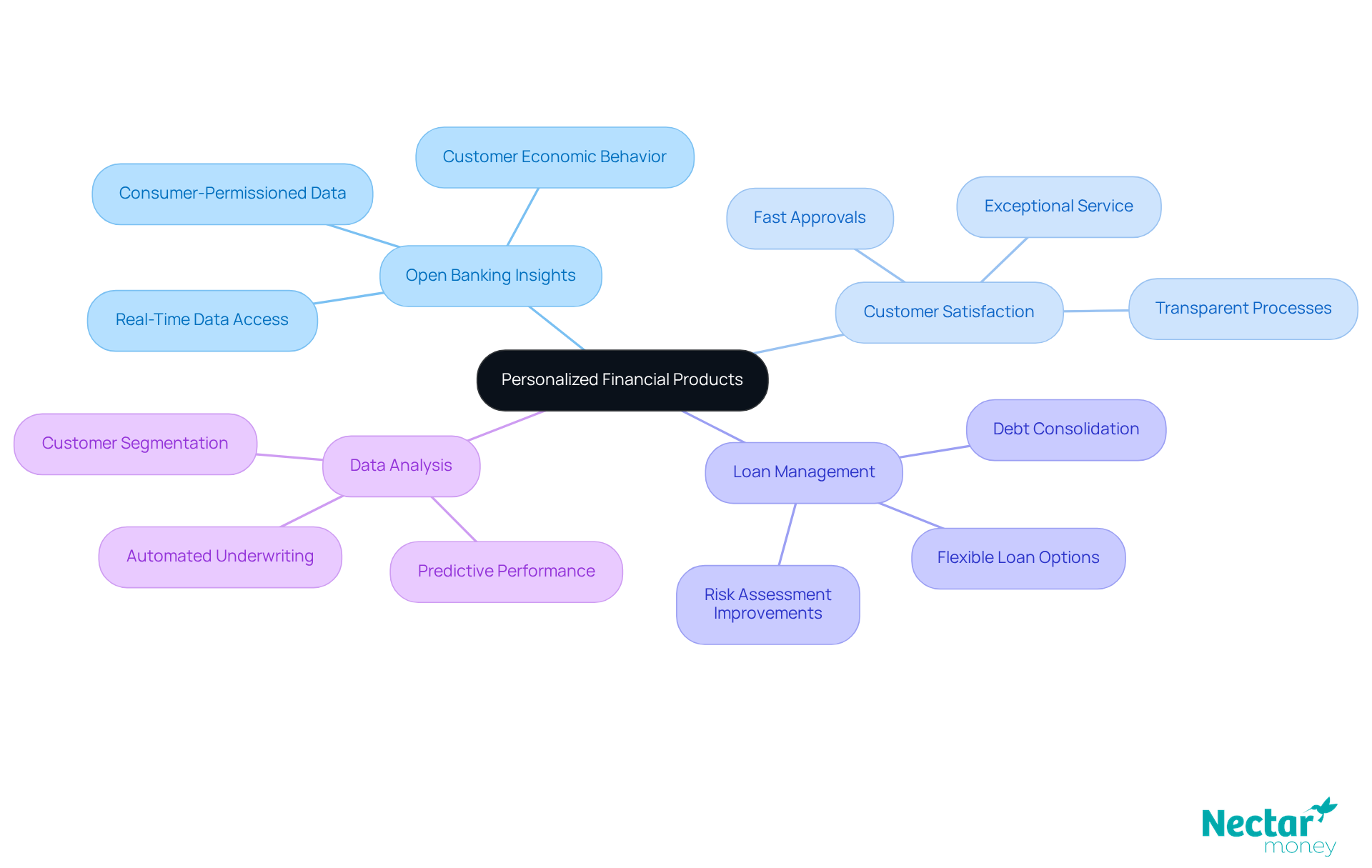

Open-banking data verification empowers companies to analyse customer economic behaviour and preferences, facilitating the creation of personalised loan products. By merging diverse data sources, companies construct a comprehensive perspective of each client’s economic condition. This enables them to offer the appropriate loan at the suitable rate, with adaptable conditions that reflect the true individual—not merely a statistic on a report. Explore your loan options anonymously, ensuring a stress-free experience.

This level of personalization significantly enhances customer satisfaction, as evidenced by numerous testimonials praising fast approvals and exceptional service. Moreover, it increases the likelihood of successful loan repayment, benefiting both lenders and borrowers alike. With Nectar Resources, managing your assets and fulfilling your monetary needs has never been simpler. Remember to evaluate your monetary situation carefully and select the loan option that best suits your needs.

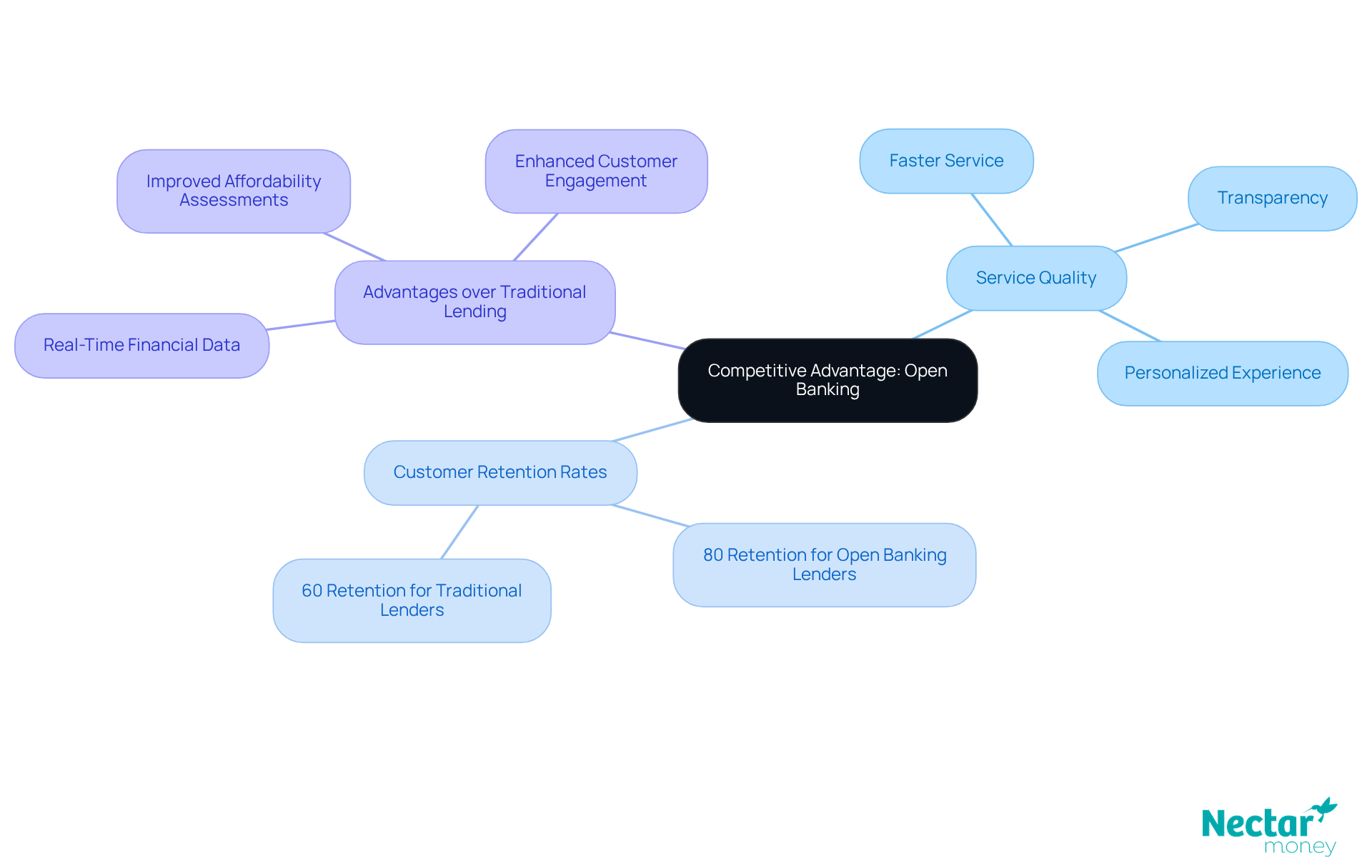

The adoption of open-banking data verification provides a significant competitive edge over traditional lenders. This innovative approach allows the company to deliver faster, more transparent, and personalised services, solidifying its position as a leader in the online lending sector. By leveraging up-to-date economic information, the company can assess borrowers’ affordability with greater accuracy, resulting in quicker lending decisions and enhanced customer experiences.

Nectar’s commitment to financial education and flexible loan options, including personal and vehicle financing, ensures that borrowers can make informed choices tailored to their unique circumstances. Statistics indicate that customer retention rates in the online lending sector are heavily influenced by service quality. For example, lenders utilising open-banking data verification have reported retention rates surpassing 80%, while traditional lenders often see rates below 60%. This stark contrast highlights the critical role of responsiveness and service quality in client retention.

Moreover, Nectar’s focus on transparency and personalised service resonates well with borrowers, fostering loyalty among existing clients. Industry experts assert that open-banking data verification not only enhances customer satisfaction but also fosters trust, which is essential for long-term retention. A case study involving a leading digital bank underscores this: after implementing open banking solutions, the bank experienced a 25% increase in customer retention within a year, attributed to enhanced service delivery and customer engagement.

Conversely, traditional lenders frequently grapple with outdated credit scoring models and protracted approval processes, which can deter potential customers. By embracing open-banking data verification, the company not only attracts new clients but also fosters a loyal customer base that appreciates improved service quality and responsiveness to their financial needs.

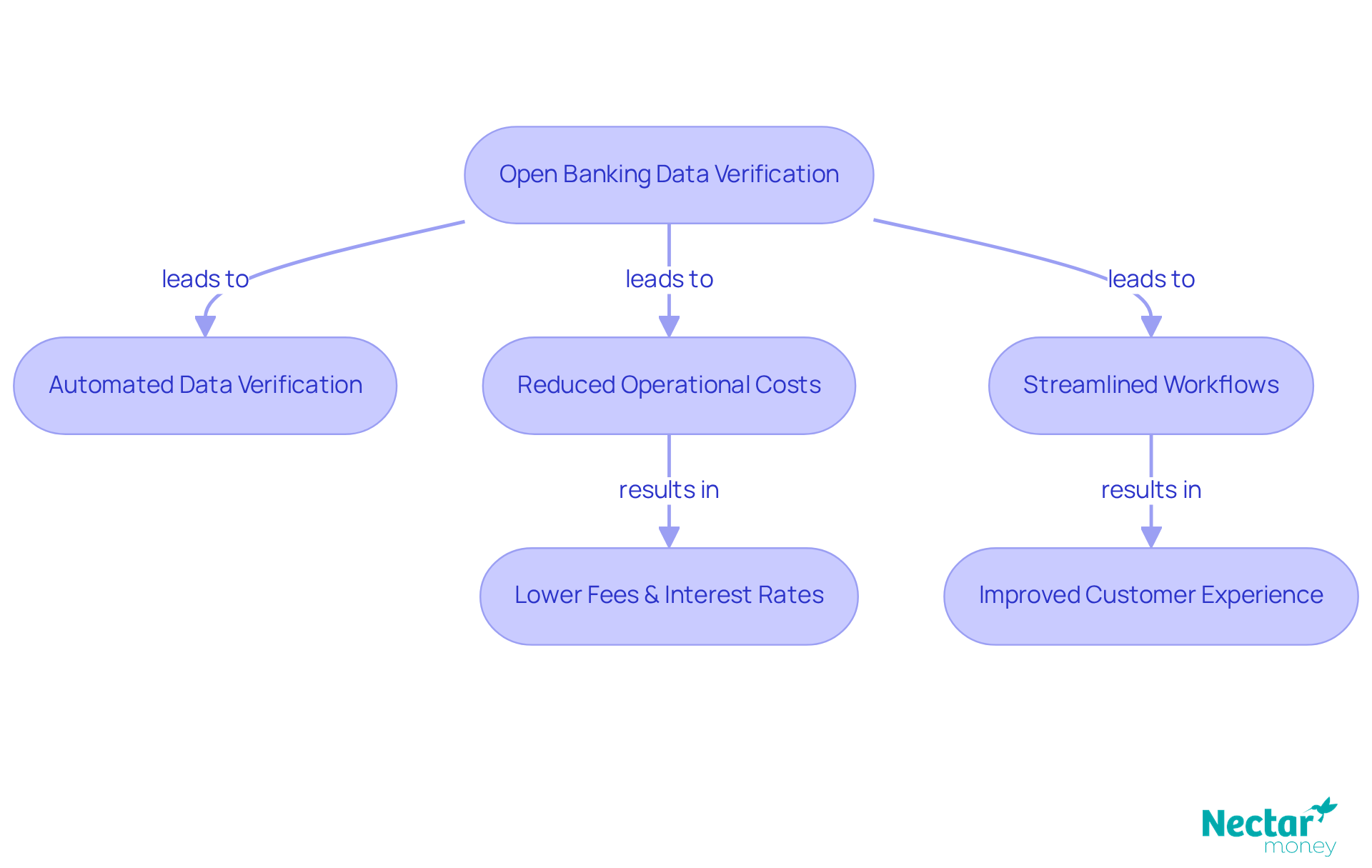

Open-banking data verification offers significant cost reductions for lenders within the industry. By automating data verification processes, companies can minimise their reliance on extensive manual labour, which typically incurs high operational costs. This automation streamlines workflows and enhances efficiency, enabling companies to allocate resources more effectively.

As a result of these savings, lenders can provide reduced fees and more attractive interest rates to consumers, with rates ranging from 9.95% to 29.95%. For example, the establishment fee is $240, accompanied by a $1.75 admin fee per repayment, allowing for flexible loan terms between 6 months and 5 years. Automation in lending operations can drastically reduce processing times, as demonstrated by Leader Bank, which decreased its underwriting processing time from seven days to just three days through digital solutions. Such efficiencies empower lenders to pass on the benefits to borrowers, making this platform an appealing option for those seeking affordable financial solutions.

Furthermore, the integration of open-banking data verification facilitates real-time verification, which further reduces the costs associated with risk assessment and creditworthiness evaluations. This shift not only improves the accuracy of lending decisions but also enhances the overall customer experience. Clients have praised the service for its quick approvals and exceptional assistance, with reviews highlighting the reliability and simplicity of their emergency loans. By leveraging these advancements, this company establishes itself as a leader in providing economical lending options, ultimately benefiting consumers on their financial journeys.

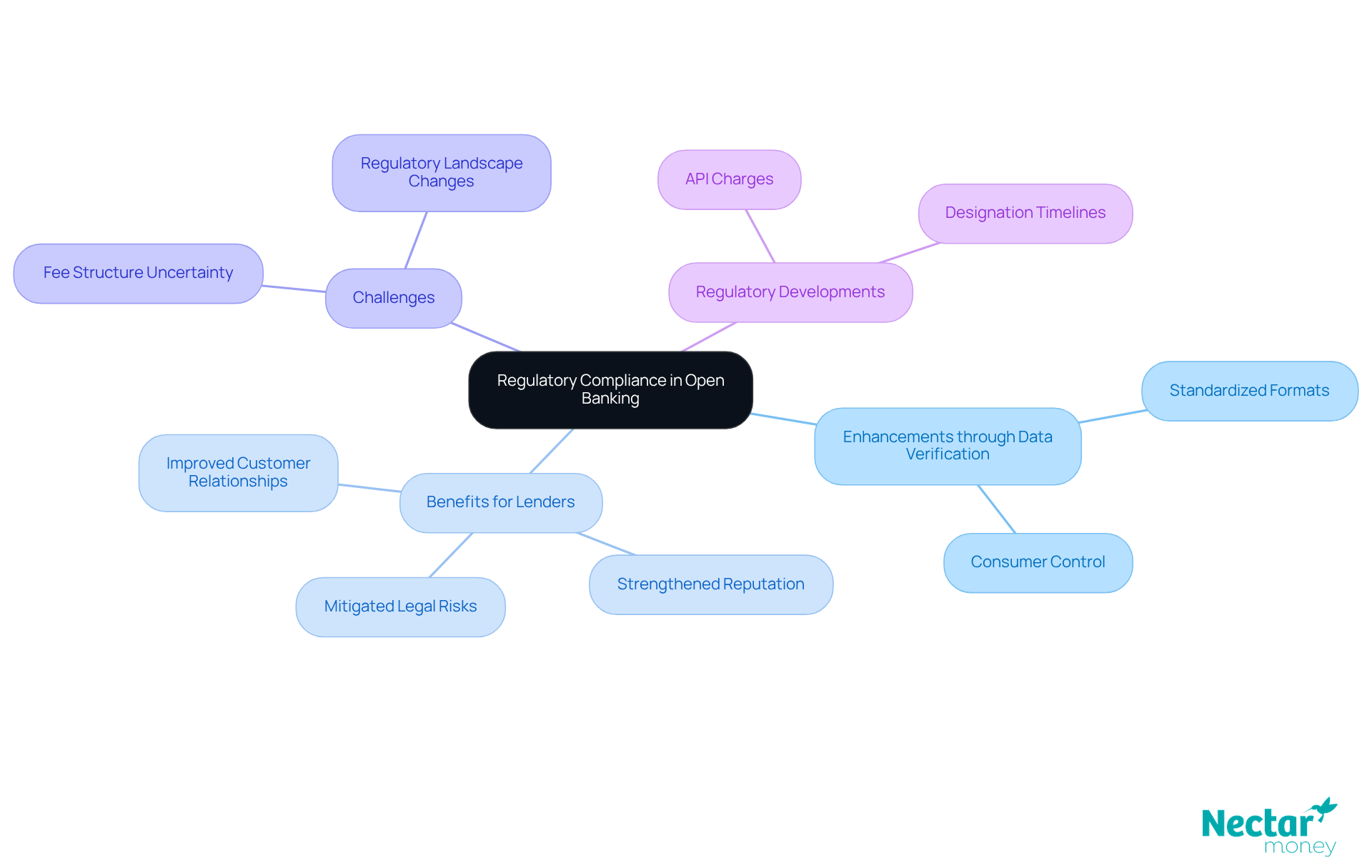

Open-banking data verification significantly enhances how lenders like Nectar Money comply with regulatory standards. By leveraging standardised information formats and secure sharing protocols, the platform adheres to industry regulations concerning information protection and consumer rights. This proactive compliance strategy not only mitigates potential legal risks but also strengthens the company’s reputation among consumers who value responsible lending practices. Furthermore, the implementation of open-banking data verification fosters clarity in lending processes, allowing consumers to have greater control over their financial information. As a result, lenders can cultivate trust and deepen customer relationships, ultimately contributing to a more robust economic system.

However, persistent uncertainty surrounding the fee structure for applications under the Act presents challenges for lenders. The designation timelines for the four largest banks and Kiwibank, set for December 2025, along with subsequent deadlines for payments and customer information, highlight the evolving regulatory landscape. A case study showcasing how a lender adeptly navigated these regulations through open banking could offer valuable insights for debt consolidators. Additionally, anticipated regulatory developments regarding API charges are essential for lenders to track, as they may influence compliance strategies. Overall, open-banking data verification not only enhances compliance but also fortifies consumer rights, positioning it as a critical element for lenders in today’s economic environment.

Open-banking data verification is essential for enhancing economic inclusion, providing access to monetary services for a broader range of consumers. By leveraging real-time data, this service uses open-banking data verification to evaluate the creditworthiness of individuals often overlooked by traditional lenders. This inclusive approach not only aids underserved communities in securing loans but also fosters a more equitable economic landscape, empowering more individuals to achieve their financial goals.

Nectar’s commitment to financial literacy and flexible loan solutions allows clients to navigate their financial needs with confidence. Testimonials from satisfied clients underscore the rapid approvals and outstanding service offered by Nectar Money. With assistance just a click away, help is readily available when emergencies arise.

Open-banking data verification is revolutionising the financial landscape, delivering substantial advantages for both lenders and consumers. By streamlining processes, enhancing transparency, and offering personalised financial solutions, this innovative approach not only boosts the efficiency of loan applications but also cultivates a more inclusive and responsible borrowing environment.

Key benefits include:

All contributing to an exceptional customer experience. The capability for consumers to access real-time financial information empowers informed decision-making, while lenders can utilise this data to customise their offerings and ensure compliance with regulatory standards. Moreover, the competitive advantage gained through open-banking data verification positions companies like Nectar Money as frontrunners in the online lending sector, fostering customer retention and satisfaction.

As the adoption of open banking expands, it is imperative for both consumers and financial institutions to embrace these innovations. By prioritising transparency, security, and efficiency, open-banking data verification not only enhances the borrowing experience but also champions financial inclusion, creating opportunities for underserved communities. The future of finance hinges on leveraging these benefits to forge a more equitable and responsive economic environment.

What is Nectar Money and how does it utilise open banking data verification?

Nectar Money is a platform that leverages open banking data verification to streamline the personal loan application process. By using real-time monetary data, it provides customised loan estimates quickly, ensuring clients receive tailored solutions based on their unique financial situations.

How does open banking data verification impact personal loan processing times?

Open banking data verification significantly reduces the time required to assess loan applications, leading to quicker approvals and funding for borrowers, which is particularly beneficial for those with urgent financial needs.

What are the anticipated benefits of open banking data verification in lending by 2025?

By 2025, the benefits of open banking data verification in lending are expected to be more pronounced, as it streamlines the loan application process and helps meet the demands of a rapidly changing economic landscape.

How does open banking enhance financial transparency for consumers?

Open banking data verification enhances financial transparency by providing consumers with real-time access to their financial information, enabling them to understand their economic standing and make informed decisions about loan options.

What is the current adoption rate of open banking in the UK?

As of now, there are 13.3 million users in the UK actively engaging with open banking services, indicating a growing adoption of this technology.

How does open banking data verification improve operational efficiency for lenders?

Open banking data verification automates the information collection and verification processes, reducing reliance on manual checks. This leads to faster application processing and improved resource distribution, with industry leaders noting potential reductions in loan processing times by up to 40%.

What feedback have clients provided about Nectar Money’s services?

Clients have praised Nectar Money for its rapid approvals and exceptional support, highlighting the platform’s commitment to providing flexible loan solutions tailored to individual needs.

* A Nectar Money loan requires responsible borrowing checks and must meet standard borrowing criteria. Interest rates 9.95% - 29.95% p.a. fixed. $240 establishment fee and $1.75 admin fee per repayment apply. Please see our privacy policy and rates and terms or visit our FAQs for the most up to date information. This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Nectar Money, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.