For many Kiwis, improving a credit score isn’t about the numbers, it’s about regaining stability, confidence and peace of mind.

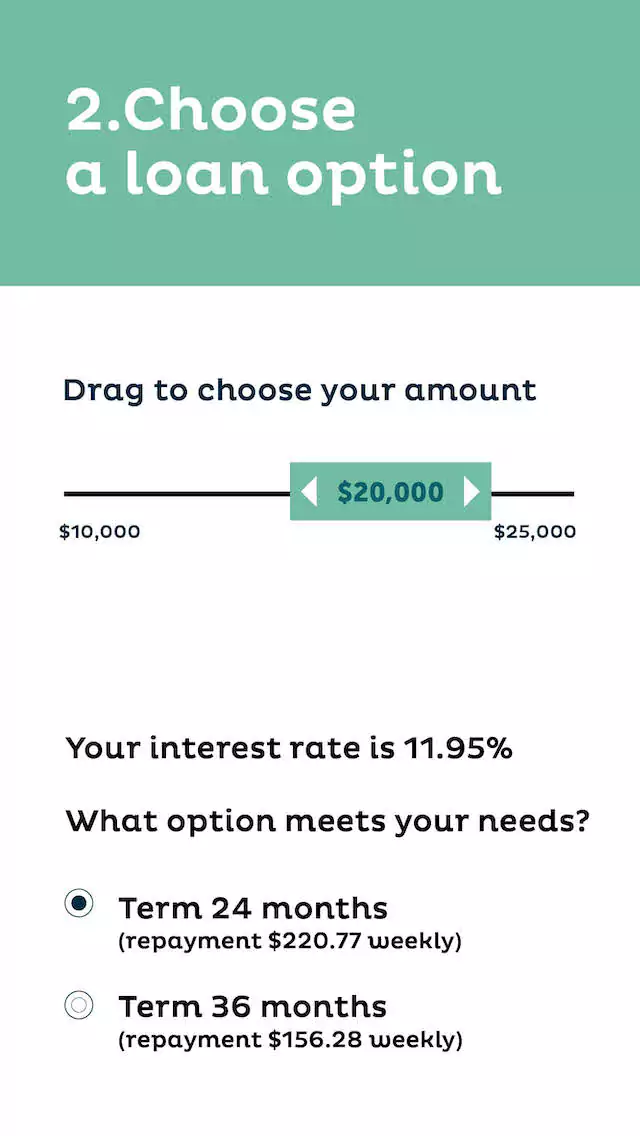

Read MoreA personal loan lets you borrow a fixed amount for planned or unplanned expenses—debt consolidation, a car, emergencies, moving, weddings, or renovations. Nectar personal loans are unsecured with a fixed interest rate and a clear repayment schedule, so repayments stay the same for the life of the loan.

See more: Is a personal loan right for you?