This article serves as a comprehensive guide for Kiwis seeking to access the Instant Finance login page. It underscores the necessity of gathering essential credentials and offers solutions to common issues that may arise. The login process is meticulously detailed, highlighting the critical role of two-factor authentication in safeguarding security. Furthermore, it emphasises the importance of effective customer support to enhance the overall user experience in online lending.

As online lending reshapes the financial landscape in New Zealand, Kiwis are increasingly turning to platforms like Instant Finance for their borrowing needs. This guide provides a comprehensive walkthrough of the Instant Finance login process, ensuring users can easily access their accounts and manage their finances effectively. However, with the convenience of digital access comes the challenge of navigating potential login issues.

How can users safeguard their information while ensuring a seamless experience? This guide will address these concerns and empower users to navigate the online lending world with confidence.

To access the Instant Finance login page, follow these straightforward steps:

https://instantfinance.co.nz/ and press Enter.As the number of users accessing online loan platforms in New Zealand continues to grow, Instant Finance has streamlined its instant finance login process to enhance user experience. This efficiency reflects a broader trend of digitalization in financial services, simplifying the management of loans for Kiwis. Understanding potential fees associated with loans, along with the importance of financial literacy, can empower you to manage your finances more effectively.

To successfully log into your Instant Finance account, it is essential to gather the following information:

Notably, a significant percentage of users forget their access codes. Studies indicate that 21% of individuals reset their codes every time they forget them, while 35% rely solely on their memory. This underscores the importance of having a dependable credential management strategy in place. The credential management sector is projected to exceed $2 billion in revenue by the conclusion of 2025, highlighting the increasing significance of these tools in managing online security. Employing credential managers can simplify this process, enabling secure storage and convenient retrieval of access details, which is especially critical in the fintech sector where secure entry to financial services is paramount.

To access your Instant Finance account, follow these straightforward steps:

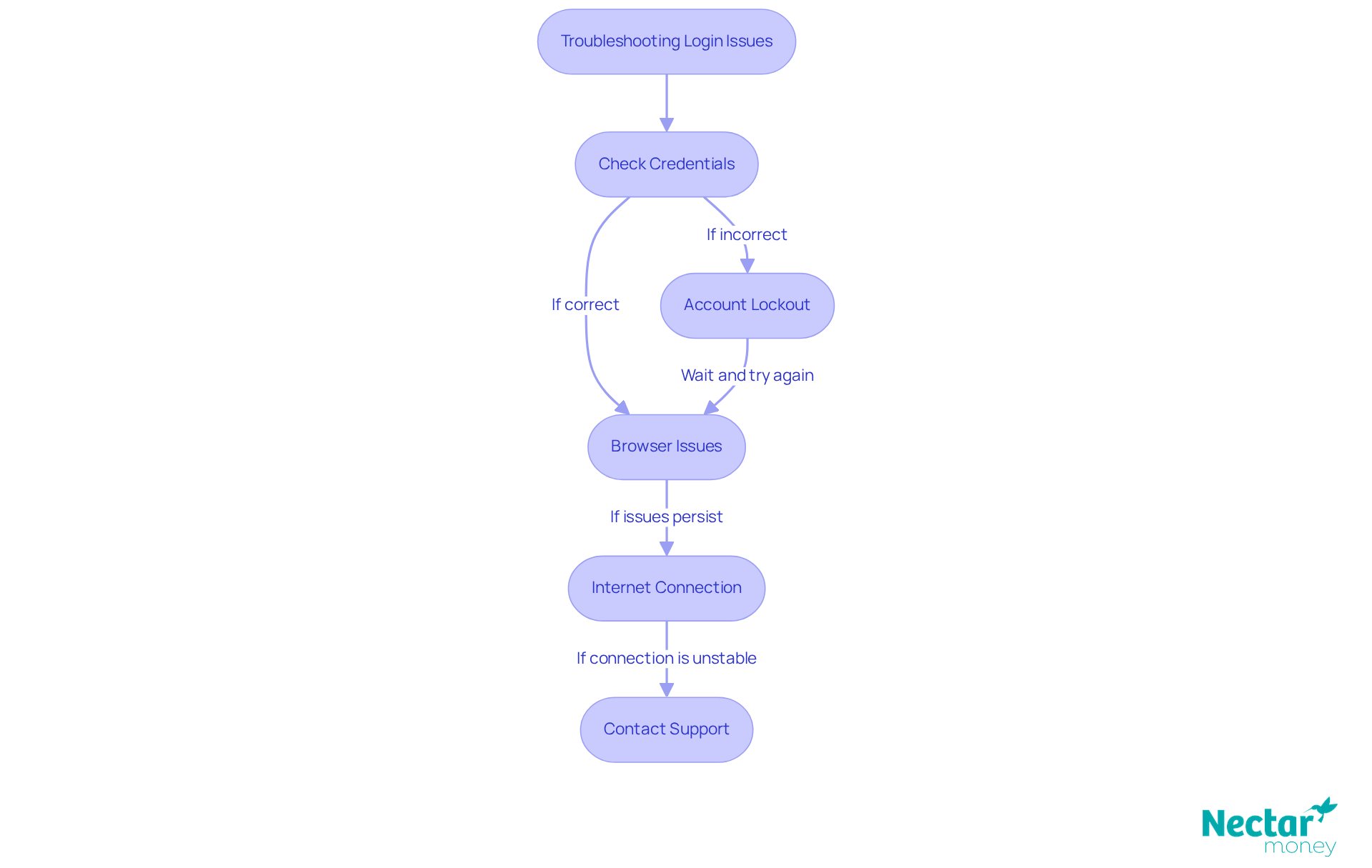

Common login issues often stem from incorrect credentials, which can lead to account lockouts. If you encounter problems, verify that your contact information and access code are correct. Should you forget your access code, utilise the ‘Forgot access code‘ option to reset it. It is crucial to ensure that your contact information and phone number associated with the account are current to receive the temporary access code.

Additionally, confirm that your browser is up-to-date and compatible with the instant finance login platform to avoid technical difficulties. If you experience multiple unsuccessful login attempts, take a moment to wait before trying again or follow the instructions to reset your access code. Lastly, cheque for any connectivity issues that might hinder the delivery of 2FA codes.

If you encounter issues while trying to log in, consider the following troubleshooting steps:

The significance of responsive customer support in online lending cannot be overstated. A study indicates that 32% of customers will cease doing business with a brand they love after just one negative experience. Therefore, having access to live support can significantly enhance customer satisfaction and foster loyalty. Additionally, a considerable percentage of users experience account lockouts, underscoring the necessity for effective troubleshooting processes. By prioritising customer support and providing clear guidance, lenders can improve the overall user experience and build lasting relationships with their clients.

Accessing your Instant Finance account is a straightforward process that empowers Kiwis to manage their financial needs efficiently. By following the outlined steps, users can seamlessly navigate the login page, ensuring they have the necessary credentials and security measures in place for a secure experience.

Essential aspects of the login process include:

The emphasis on two-factor authentication underscores the importance of security in online financial transactions. Additionally, acknowledging potential login challenges highlights the need for effective support and user education.

Understanding the Instant Finance login process not only facilitates easier access to financial services but also enhances overall financial literacy among users. By prioritising security and staying informed about potential challenges, individuals can take control of their financial journeys with confidence. Embrace the convenience of digital finance and ensure a smooth login experience by following the guidance provided.

How do I access the Instant Finance login page?

To access the Instant Finance login page, open your web browser and type the URL: https://instantfinance.co.nz/ in the address bar. Press Enter, then click on the ‘Login’ option located at the top right corner of the homepage.

What should I do if I’m using a mobile device to access the login page?

If you are using a mobile device, ensure that your browser is updated for optimal performance when accessing the Instant Finance login page.

Why is the Instant Finance login process important?

The Instant Finance login process is important as it reflects the growing trend of digitalization in financial services, making it easier for users to manage their loans efficiently.

What is the significance of understanding potential fees associated with loans?

Understanding potential fees associated with loans is significant as it empowers users to manage their finances more effectively and make informed decisions.

* A Nectar Money loan requires responsible borrowing checks and must meet standard borrowing criteria. Interest rates 9.95% - 29.95% p.a. fixed. $240 establishment fee and $1.75 admin fee per repayment apply. Please see our privacy policy and rates and terms or visit our FAQs for the most up to date information. This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Nectar Money, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.