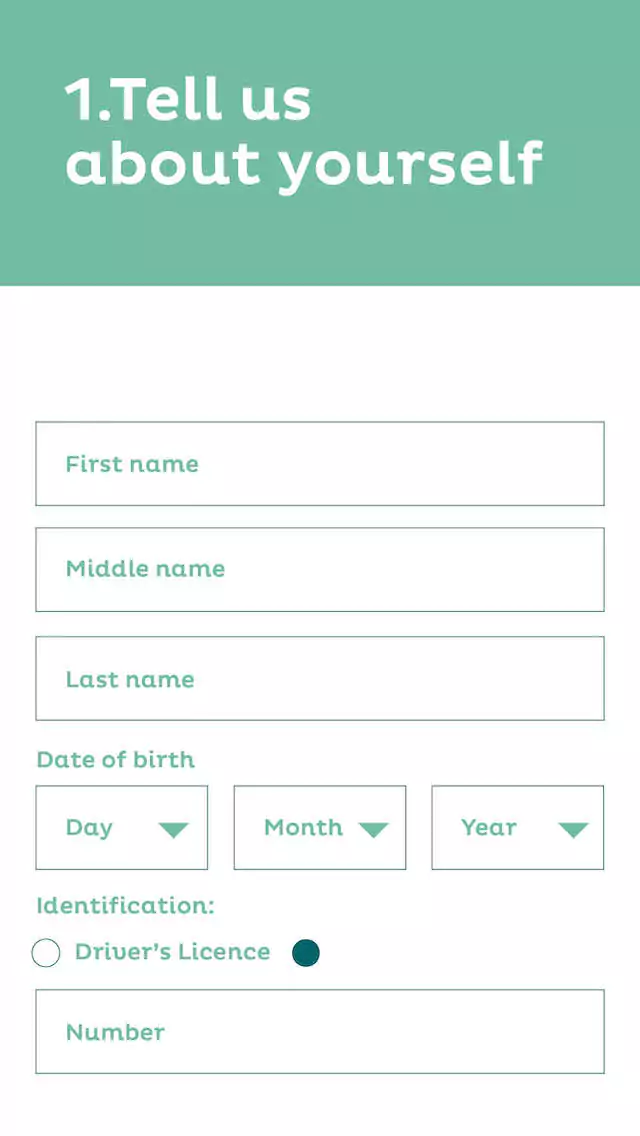

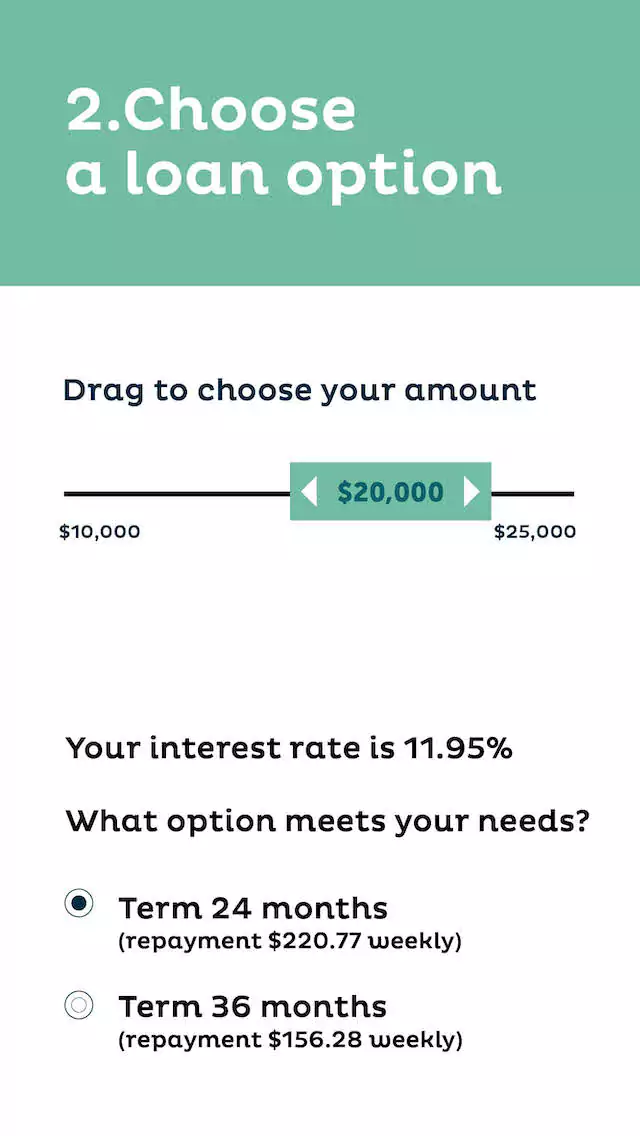

If you're feeling the pressure of managing multiple debts, a debt consolidation loan could be a sensible next step.

Read MoreA debt consolidation loan allows you to combine multiple debts into a single personal loan. Instead of juggling several loan repayments each month, each with different interest rates and amounts to repay, you will only have a single monthly payment to budget for. The most frequently consolidated debts are personal loans, credit cards, auto loans or car loans, and Buy now, Pay later balances.

Merging all your debt into a single loan doesn't reduce your total debt. This consolidation approach simplifies the management of your debt, and can reduce your total interest payments.